Tax taken off paycheck

Divide the sum of all assessed taxes by the employees gross pay to determine the percentage of taxes. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly.

Mathematics For Work And Everyday Life

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

. Hourly Paycheck and Payroll Calculator. Your average tax rate is 270 and your marginal tax rate is 353. If youre single and you live in Tennessee.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Income tax deducted If you receive employment income or any other type of income your employer or payer will deduct income tax at source from the amount paid. Your employer withholds 145 of your gross income from your paycheck.

How to Calculate Taxes Taken Out of a Paycheck. The federal government collects your income tax payments. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at. There are no income limits for. If you find yourself always paying a big tax bill in April take a look at your W-4.

You can find the amount of federal income tax withheld on your paycheck stub. Heres how to make it work for you. Federal income taxes are paid in tiers.

These taxes together are called FICA taxes. You pay the tax on only the first 147000 of. If an employer treats you as an independent contractor issuing you a Form 1099-MISC you must claim the amount shown in Box 7 Nonemployee compensation as income on your tax return.

You can thank payroll taxes for that. You and your employer will each contribute 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes. One option that you have is to ask your employer to withhold an additional dollar amount from your.

QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Form W-4 tells your employer how much tax to withhold from each paycheck. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Currently the amount of Social Security taxes withheld from your payroll is 62 percent of your gross wages up to a certain amount for 2018 only wages up to 128400 are. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

How to have less tax taken out of your paycheck. If youre an employee this is accomplished by your employer who withholds your income and Social Security and Medicare taxes from your paychecks and sends the money to. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches.

They take a big bite out of paychecks each month and just how big depends on where you live. How Your New Jersey Paycheck Works. Your employer pays an additional 145 the employer part of the Medicare tax.

For a single filer the first 9875 you earn is taxed at 10. Need help calculating paychecks. Lets say you have 150 withheld each pay period and get paid twice a month.

Your New Jersey employer is responsible for withholding FICA taxes and federal income taxes from your paychecks.

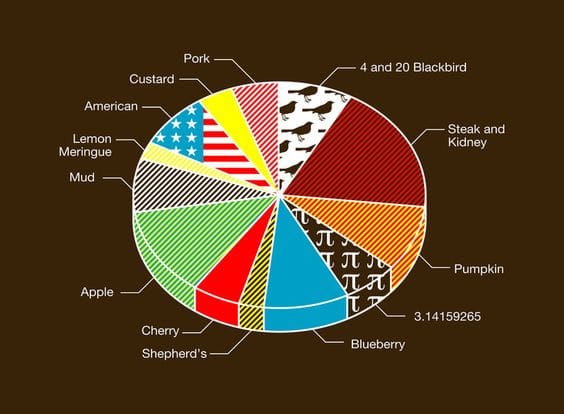

The Measure Of A Plan

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Mathematics For Work And Everyday Life

Check Your Paycheck News Congressman Daniel Webster

Pay Stub Meaning What To Include On An Employee Pay Stub

Decoding Your Paystub In 2022 Entertainment Partners

Different Types Of Payroll Deductions Gusto

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

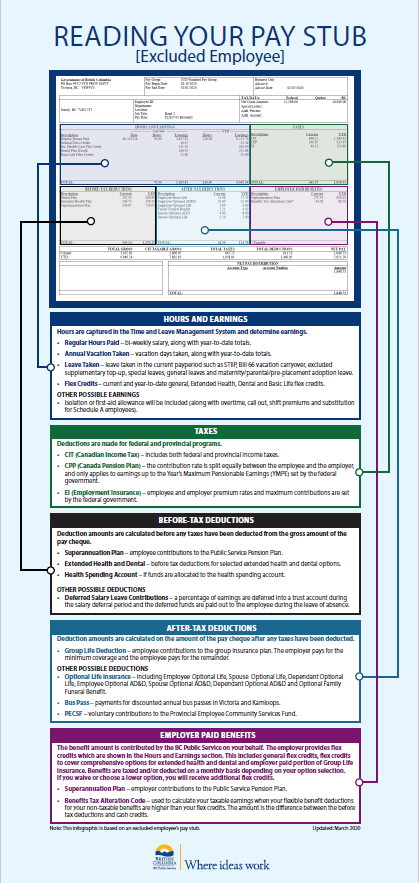

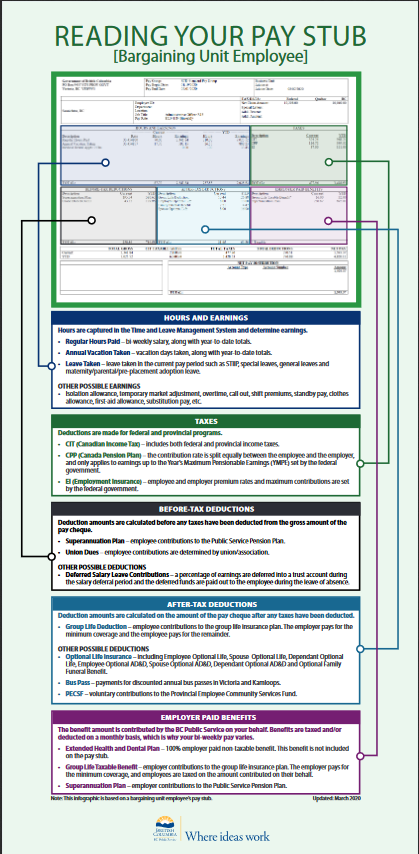

How To Read Your Pay Stub Province Of British Columbia

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

How To Calculate Payroll Tax Deductions Monster Ca

The Measure Of A Plan

How To Read Your Pay Stub Province Of British Columbia

Paycheck Calculator Online For Per Pay Period Create W 4

How Does A Paycheck Look Like In Canada What Are The Deductions Quora

Payroll Taxes Here S A Breakdown Of What Gets Taken Out Of Your Pay And What You Are Taxed On Youtube

Understanding Your Paycheck